SBL Capital is part of the Alken Asset Management group

SBL Capital is the management company

of European Secured Bridge Financing 1 Fund

SBL Capital invests in a diversified pool of senior loans secured with a property asset, providing short term bridge financing to SME’s across Europe

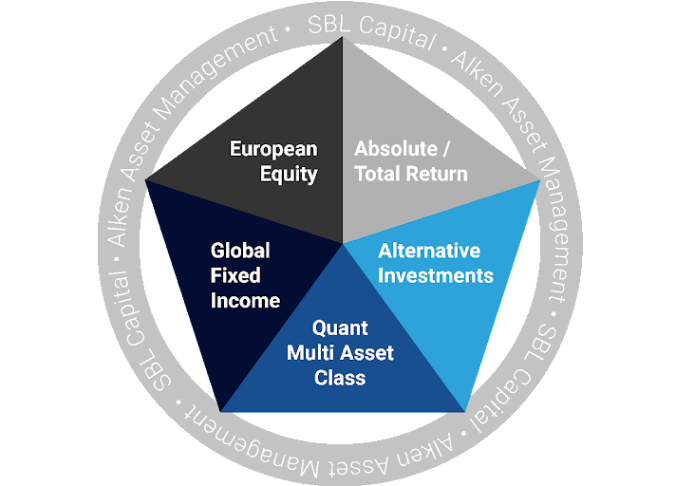

- Multi-asset specialist boutique (Equities, Fixed Income and Alternative Strategies)

- EUR1.5bn AUM across multiple funds and segregated mandates

- Independent asset manager, founded in 2005, and recognized intensive fundamental research expertise

- Extensive resources dedicated to research and portfolio management

- Alternative Investments is a division of Alken Asset Management Ltd in charge of managing the secured bridge financing strategy

Few facts

2005

Year of Creation

1,5

Asset under management (billion euros)

16

Investment analysts*

*among which two contributors in Paris as consultants

3

Strategy expertises

Alken Asset Management

2005

Alken Asset Management was established in 2005 out of loyal investors’ trust in Nicolas Walewski’s proven ability to consistently outperform the European Equity Market.

2017

Alken decides to start a quantitative business with the launch of Cabestan Quant Research.

2018

Alken AM starts managing two new fixed income funds, run by Portfolio Manager Antony Vallee. Alken AM revisits its ESG strategy and among other things, starts working on developing its internal “ESG taxonomy”.

2020

After years of efforts working on its ESG enhancements:

- Alken receives the overall entity-level Score A according to the UNPRI annual reporting framework.

- Three strategies are granted the ESG LuxFLAG Label.

2021

After four years of in-depth research, the first quant strategy is launched.

ESG continues to become part of most of the strategies’ DNA:

- All except one strategy are categorised Article 8 SFDR,

- The ESG LuxFLAG Labels are renewed for three of our strategies.

2022

We acknowledge that alpha creation requires differentiating ourselves from the crowd but we remain risk aware.

On ESG, we are heavily working on managing better our climate data and committing to strict climate disclosures, including taxonomy alignment disclosures.

2023

SBL Capital is created, Launch of the Private Debt Fund